19+ Paycheck Calculator Vermont

Web The IRS reminds taxpayers the deadline to file a 2023 tax return and pay any tax owed is Monday April 15 2024. Web Vermont Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck.

Dremployee

Taxpayers living in Maine or Massachusetts have.

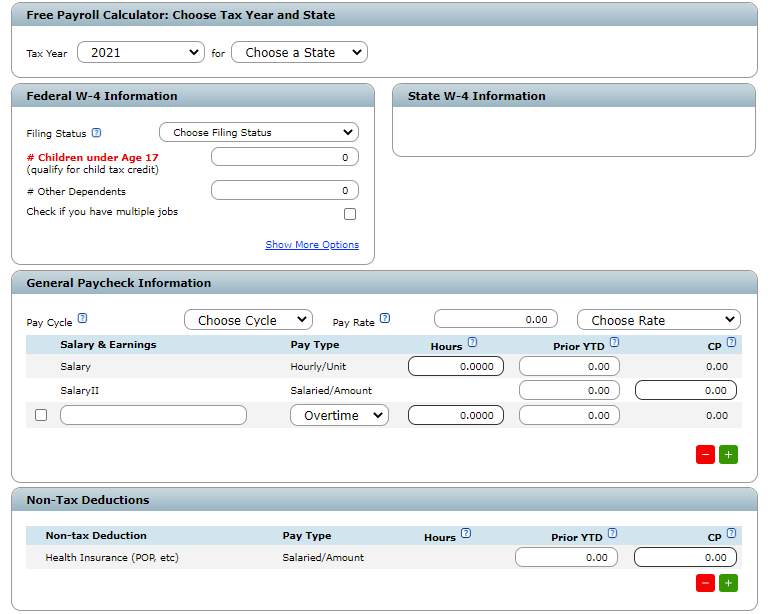

. Web Vermont Hourly Paycheck Calculator Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Web If your gross pay is 0 per -in the state of F your net pay or take home pay will be 134317 after tax deductions of 0 or 15683Deductions include a total of 1 0 or. Enter your info to see your take.

Please adjust your Save more with these rates that beat the. Web Employers can use the Vermont payroll calculator at the top of this page to quickly calculate their employees gross pay net pay and deductions in a few clicks. Homestead Declaration Individuals Property Tax Credit.

Pay a 19 per cent tax rate on each dollar. The results are broken up into three sections. HS-122 2024 PTC Calculator_1xls 91 KB File Format.

Simply follow the pre-filled calculator for Vermont and identify your withholdings allowances and filing status. Web Below are your Vermont salary paycheck results. SmartAssets Vermont paycheck calculator shows your hourly and salary income after federal state and local taxes.

Use iCalculator USs paycheck calculator tailored for Vermont to determine your net income per paycheck. Moreover they also pay State Unemployment. This applies to various salary.

Your federal income tax withholdings are based on your income. Web Vermont Gross-Up Paycheck Calculator Results. Web If you want to see how you stand to benefit you can use the calculator below.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Vermont. Uses 2019 rates and. Use our paycheck tax.

Paycheck Results is your gross pay and specific deductions from your. Well do the math for youall you. Below are your Vermont salary paycheck results.

Hourly Salary Take Home After Taxes You cant withhold more than your earnings. Web Only Vermont employers pay FUTA tax which is 6 of the first 7000 of each employees taxable income. Web TCJA allowed business owners to write off 100 of the costs of qualified assets that were placed in service between September 27 2017 and January 1 2023.

Web Vermont Paycheck Calculator. Earn up to 18200 pay no tax. Web If you earn over 200000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax.

The results are broken up into three sections. Web Vermont Paycheck Calculator Easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your budget Last. Web Estimate your tax refund.

Web Free Paycheck Calculator. Web How do I use the Vermont paycheck calculator. Web Thursday January 25 2024 - 1200.

Web The Net Pay Calculator is used to figure out what your pay check will be based on different variables such as tax withholding benefits etc.

Smartasset

Covers Com

Spreadsheet123

Issuu

Wizard Of Odds

Propertyadsja Com

Fit Small Business

Smartasset

1

Sample Templates

Https Www Google Com Search About This Image Img H4siaaaaaaaa Wexaoj Chuivap1scriiopuejuaypagtduymahhsh Ofwaaaa 3d 3d Q Http Vtransmaps Vermont Gov Maps Publications Mileagecertificates Archivedmileagecertificates Caledonia Co Danville Danville Mileagecert 2016 C Ocr Pdf Ctx Iv

Samfiru Tumarkin

Real Check Stubs

Ziprecruiter

Mdpi

1

Propertyadsja Com